Part time calculator salary hourly

There are two options in case you have two different. Hourly Calculator Federal Hourly Paycheck Calculator or Select a state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent.

Hourly To Salary Chart Salary Calculator To Hourly Popular 3 Ways To Calculate Your Real 1397 Notes Template Free Therapy Family Therapy

So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the California Salary Calculator uses California as default selecting an.

. You can also determine the hourly wage of an employee by dividing their annual salary by the number of hours they work in a year. For example for 5 hours a month at time and a half enter 5 15. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

For a monthly-rated part-time. Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table. Assuming you make a hundred thousand dollars in 12 months your hourly wage is 100000 2080 or 4807.

Hourly Wage Calculator This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay. Next divide this number from the. Hourly and daily pay for part-time employees If you are a part-time employee paid by the month you can calculate your hourly and daily basic rates of pay.

For example for 5 hours a month at time and a half enter 5 15. There are two options in case you have two different. Enter the number of hours and the rate at which you will get paid.

Then divide the resultant value by the number of hours you work per week. Your employer withholds a 62 Social Security tax and a. To decide your hourly salary divide your annual income with 2080.

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Enter the number of hours and the rate at which you will get paid. How do I calculate hourly rate.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. To calculate the hourly rate on the basis of your monthly salary firstly multiply your monthly salary by 12. Based on a standard work week of 40 hours a full-time.

Salary Calculator

Hourly To Salary Calculator

Hourly Rate Calculator

3 Ways To Calculate Your Hourly Rate Wikihow

Infographic How To Calculate Your Freelance Hourly Rate Photography Business Infographic Freelance Business

Wages And Salary Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

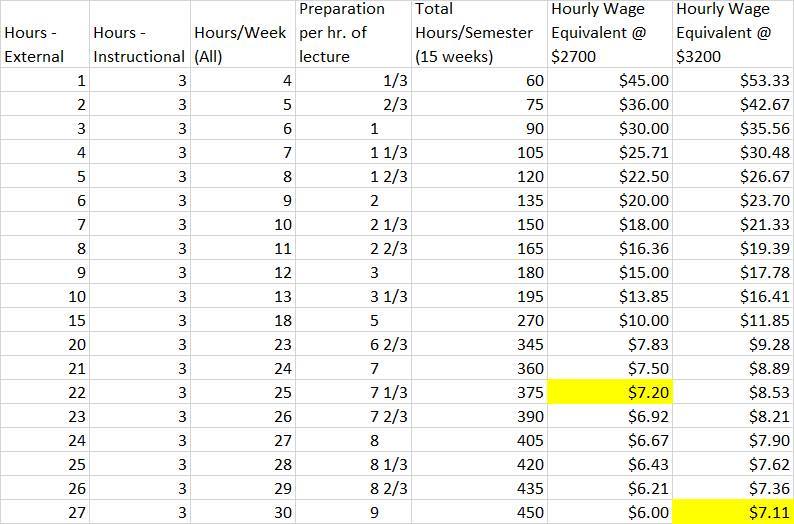

An Adjunct S Guide To Calculating Your Hourly Wage Equivalent Phillip W Magness

Hourly Rate Calculator

Salary To Hourly Salary Converter Salary Hour Calculators

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

Rotation Schedule Excel Template Employee Worksheet Excel Etsy Excel Templates Salary Calculator Templates

Real Hourly Wage Calculator To Calculate Work Hour Net Profit

Calculating Hourly Pay For Secondary Special Education Life Skills Students Life Skills Special Education Special Education Life Skills Classroom

Salary To Hourly Paycheck Calculator Omni Salary Budget Saving Paycheck

Hourly To Salary What Is My Annual Income